Most business and HR leaders think of attrition as an internal problem. It is not.

It is a market problem.

A company’s attrition rate reflects the quality of the company’s interaction with the talent market. A low-quality interaction is reflected in a high attrition rate. A high-quality interaction results in a low attrition rate.

There is a stack of analytics, mostly correlations, that claims prediction of attrition through co-relation with competencies, engagement, source of hire, years of service, campus relatability and others. All these correlations matter little because, in reality, attrition is a market choice indicator.

This is how it works

Two main factors drive attrition: Performance and Price.

When performance is not matched with price, attrition happens.

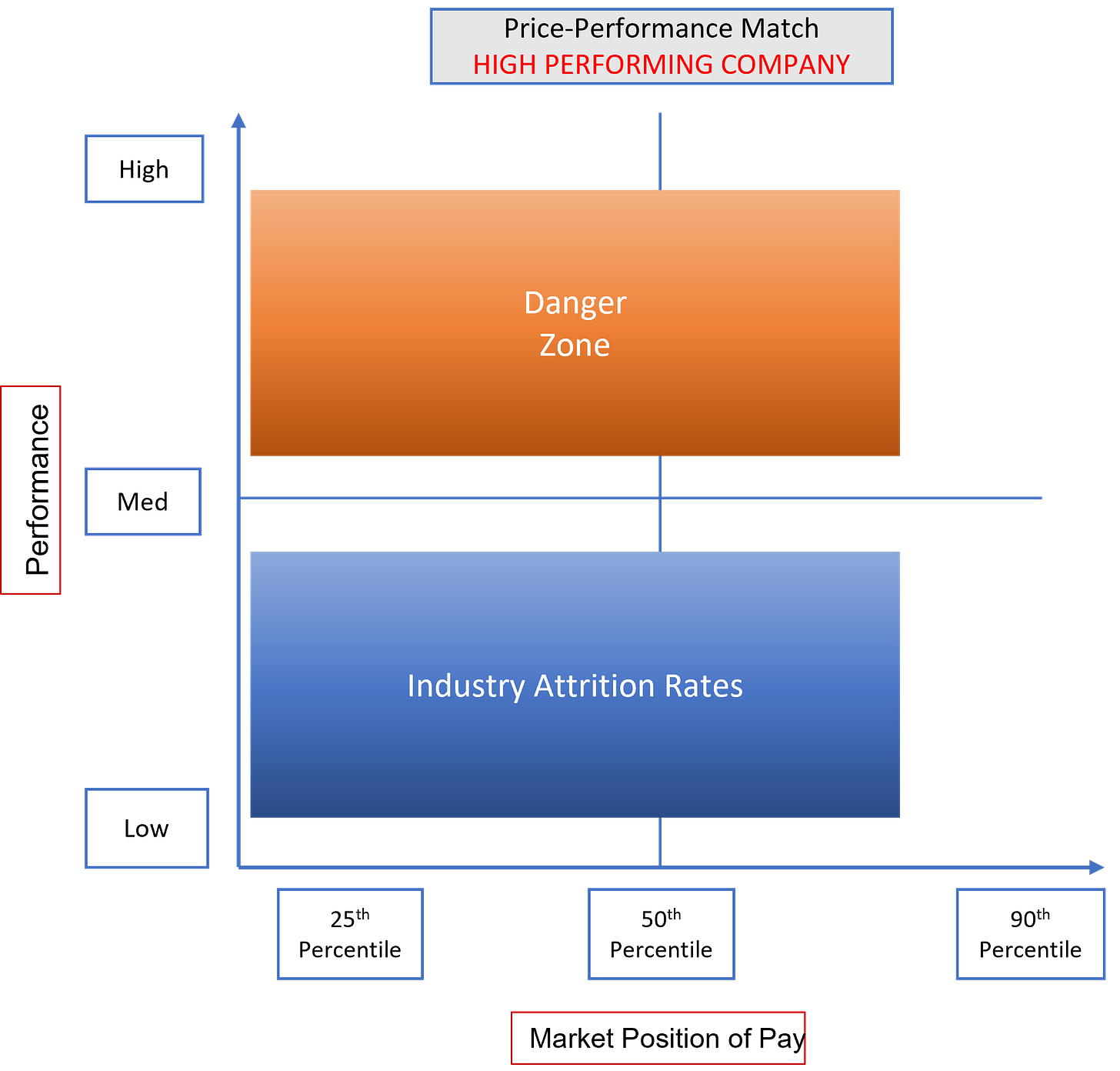

The ‘Price-Performance Match™’ chart below can be applied to a company or a TVC within a company.

If ‘X’ % of employees in a TVC (or a company) are high performers and are paid at 50th percentile of the market, the company is likely to lose 50% of that group over a period of one or two years. If similar high performers are being paid at 75th percentile, the likely loss in this group will be 25%. This is the cell labelled ‘Z’% of TVC in the chart above.

While the above chart is quite straightforward, a company’s interaction with the market is slightly more nuanced.

High performers in high performing companies are valued more by the market than high performers in companies performing at the median level.

If a high performer in a high performing company is paid at 50th percentile, the market is more likely to extract them from their current company, compared to a similar performer in a company performing at the median level.

Let’s bring this all together.

Step 1:

Think of your company. Where does it stand in the industry? Is it considered a high performing company? Or a ‘median-performing’ company?

Step II:

Plot your talent on this grid and identify employees in the danger and the industry zones.

Your attrition risk can be approximated by this formula:

For High Performing Companies:

For Median Performing Companies

Step III

75% of your attrition can be predicted by the Price-Performance Match in Steps I and II.

There could be an overflow to the above number. The one factor that impacts this overflow the most is ‘The Manager.’ See chart below.

If your attrition is higher than the result in step II, you may want to look at the quality of leadership in TVCs where this is happening. If there is no market reason for talent to leave, and it is still leaving, then the cause is leadership. The important thing to remember is: Point a finger to leadership after the Price-Performance Match analysis has already been done.

Before we close, you may be wondering: What if my company cannot afford to pay market salaries? This is a good question. This is where a segmented HR strategy, which we will come to later, becomes important.

In short, managing attrition is mainly an analytical exercise related to the market.

All noise, tension and discussion around any other factor is of limited value. At its worst, attrition noise leads to more attrition. Middle level managers and leaders at the receiving end of this noise get frustrated. They find themselves sandwiched between the noise and the helplessness of their effort.

To retain talent, match price with performance, instead of screaming at the manager in the middle.

Couldn't agree more with everything penned here 👌🏻

Absolutely true and straight forward..